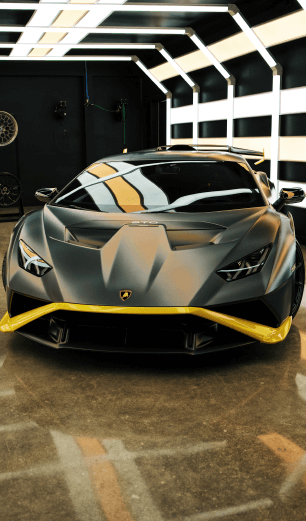

Car Loan

Scroll Down

Online and mobile banking provide convenient access to your accounts, allowing you to check balances, make transfers, pay bills

Business loans in India can be availed in the range of Rs.50,000 and up to Rs. 75 Lakhs. These loan applications usually get approved fairly quickly and sans any hassle during promise of secured lending solutions when it comes to business loans.

This section provides an overview of what banking is and its importance in the financial system.

Apply now

Online and mobile banking provide convenient access to your accounts, allowing you to check balances, make transfers, pay bills

Banks set interest rates based on factors like the federal funds rate supply and demand for savings.

Online and mobile banking provide convenient access to your accounts.

The Federal Deposit Insurance deposits in participating banks $250,000 depositor per.

While a savings account is for storing money and earning interest.

Get business loan offers at great interest rates

Apply now

Please fill the form below. We will get in touch with you within 1-2 business days, to request all necessary details

If you notice any suspicious or unauthorized activity on your account, follow these steps: 1. Contact your bank or credit card issuer immediately. 2. Report the fraudulent transactions and provide details of the unauthorized activity. 3. Request to block or deactivate the affected card or account. 4. Follow any additional instructions provided by your bank to resolve the issue.

If you notice any suspicious or unauthorized activity on your account, follow these steps: 1. Contact your bank or credit card issuer immediately. 2. Report the fraudulent transactions and provide details of the unauthorized activity.

If you notice any suspicious or unauthorized activity on your account, follow these steps: 1. Contact your bank or credit card issuer immediately. 2. Report the fraudulent transactions and provide details of the unauthorized activity. 3. Request to block or deactivate the affected card or account.

If you notice any suspicious or unauthorized activity on your account, follow these steps: 1. Contact your bank or credit card issuer immediately. 2. Report the fraudulent transactions and provide details of the unauthorized activity. 3. Request to block or deactivate the affected card or account. 4. Follow any additional instructions provided by your bank to resolve the issue.

If you notice any suspicious or unauthorized activity on your account, follow these steps: 1. Contact your bank or credit card issuer immediately. 2. Report the fraudulent transactions and provide details of the unauthorized activity. 3. Request to block or deactivate the affected card or account. 4. Follow any additional instructions provided by your bank to resolve the issue.